Despite a gradual decline from the peak of 2014, non-performing loans remain an important problem in several Eurozone countries. Furthermore, the economic implications of the Covid-19 pandemic may undermine the result of the deleveraging of NPEs that began in 2015 which produced a steady reduction in the stock of non-performing loans in the euro area and translated into a significant increase in the share of defaulting loans.

The interconnections between non-performing loans, the banking sector and the overall macroeconomic system suggest that an increase in NPEs has a negative effect on GDP growth, depresses bank credit and leads to a decline in residential property prices. Therefore, we can understand the importance of adopting economic measures associated with structural prudential policies that address the resolution of the problem of non-performing loans1.

In the period preceding the pandemic, the reduction in non-performing loans had allowed market operators to focus their attention on UTPs (here for more information), the economic situation following the Covid-19 emergency led to total uncertainty about the evolution of the market in the years to come, with forecasts of a probable increase in the total volume of exposures (NPE), both non-performing and unlikely to pay (UTP), due to the new flows of NPEs arriving, whose volume can be hypothesized to be between 80/100 billion in the next 24/30 months.2

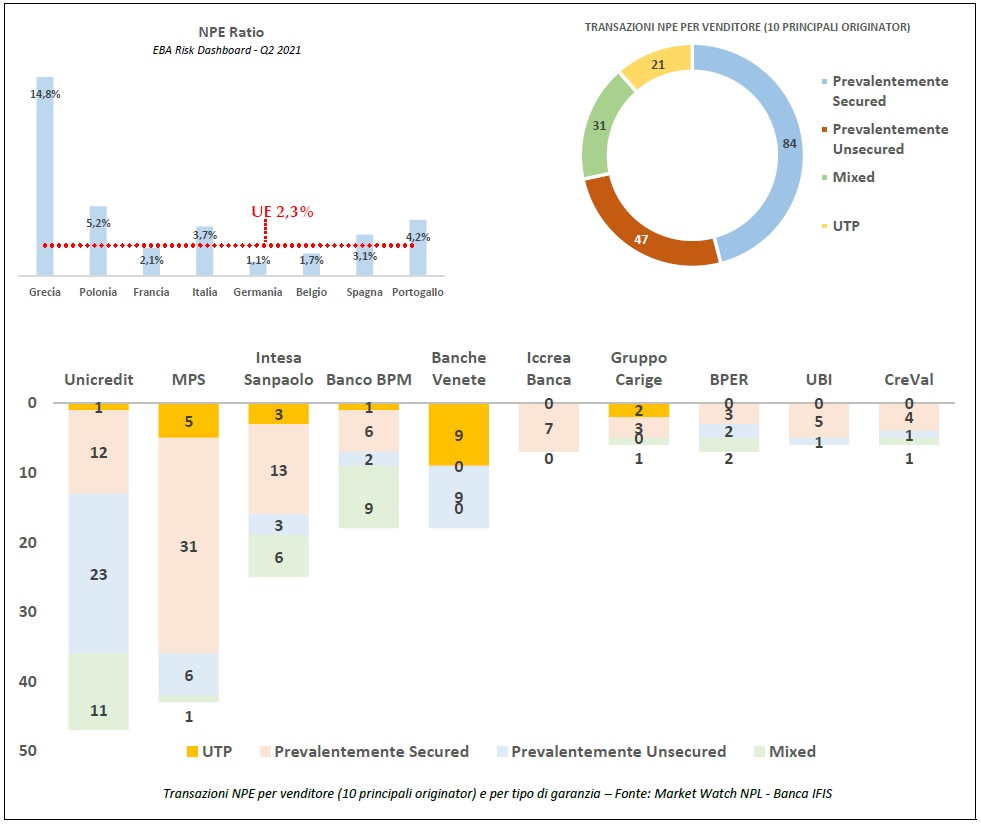

The public support measures (moratoriums on outstanding loans, freezing of layoffs and guaranteed loans) have had an important role in containing credit risk throughout 2020 and in the first part of 2021, avoiding a possible credit crunch and slowing down the issuance of NPLs, with an NPE ratio below the 5% threshold as required by the ECB. In 2022, with the end of the moratoriums, a default rate of 3% is expected (up from 1.4% in 2021)3 with a stock of UTPs that will be higher than that of NPLs and with NPE flows that will come mainly from the small and medium-sized enterprises belonging to the sectors most affected by the crisis.

Bank consolidation, calendar provisioning and ECB guidelines will oblige banks to continue their deleveraging strategy, also with the support of the one-year extension of the GACS which will bring about 7 billion of new guaranteed transactions for a total amount of 94 billion of securitized portfolios from 2016 to today.

Article by Augusto Vassallo, Ufficio Studi e Reporting (Studies and Reporting Office), Morning Capital

Notes and sources

1 (source: SUERF Policy Note Issue No. 185, July 2020)

2 (source: PWC - The Italian NPL Market – 07/2021)

3(source: Market Watch NPL – Banca Ifis)

Glossary

- NPL (non-performing loans)

- NPE (non-performing exposures) - Loans from banks (mortgages, funding, loans) that debtors are no longer able to repay regularly o totally. In practice, these are loans from banks whose collection is uncertain both in terms of compliance with the deadline and of the amount of capital exposures. NPEs fall into three subclasses:

- Bad Loans - In the category of bad loans, the most serious for the bank, converge all receivables which the bank has from debtors who are in a state of insolvency or in essentially similar situations, regardless of any loss forecasts formulated by the bank. This insolvency state need not be established.

- Unlikely to Pay (UTPs) - These are exposures which the bank deems that a full fulfillment by the debtor is unlikely without recourse to actions such as the enforcement of guarantees. When we talk about non-fulfillments, we refer either to principal or to interest (or to both).

- Past due and/or overdue impaired exposures (Past Dues) - Past due and/or overdue impaired exposures are exposures (other than those classified as bad loans or probable defaults) which are either overdue or have exceeded credit limits for over 90 days and are beyond a predefined relevance threshold.

- Performing loans – Are the exposures that the bank considers solvent, that is, that will be able to be repaid according to the established methods agreed upon with the financial institution.

- Forborne exposures - These are loans, not necessarily non-performing, subject to forbearance by the lender, which constitute a modification to the original contractual conditions of the credit line (e.g. extension of the amortization period of the loan or reduction of the interest rate).

-

- Forborne performing exposures - They concern performing (in bonis) customers with no financial difficulty

-

- Non-performing exposures with forbearance measures - Impaired exposures subject to forbearance.

- Calendar provisioning - It refers to a set of rules set by European subjects on the capital requirements of banks, introduced with the aim of improving the quality of banks' assets by determining the minimum levels of prudential provisions that must be held by banks.

- NPE ratio – It is an indicator used by the Supervisory Authorities to monitor the credit risk of banking institutions; it corresponds to the ratio between non-performing loans (NPEs) and loans granted.

- GACS (Guarantee on Securitization of Bad Loans) – A type of credit enhancement aimed at reducing the risk for the investor. Italian Decree-Law No. 18 of February 14, 2016 provides that the Ministry of Economy and Finance may grant a state guarantee for the repayment of principal and interest on securities issued through securitization transactions.